tn franchise and excise tax mailing address

ET-1 - Excise Tax Computation. 163 j in Relation to the Excise Tax.

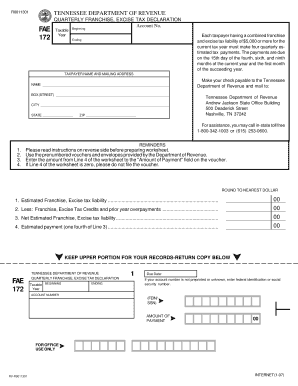

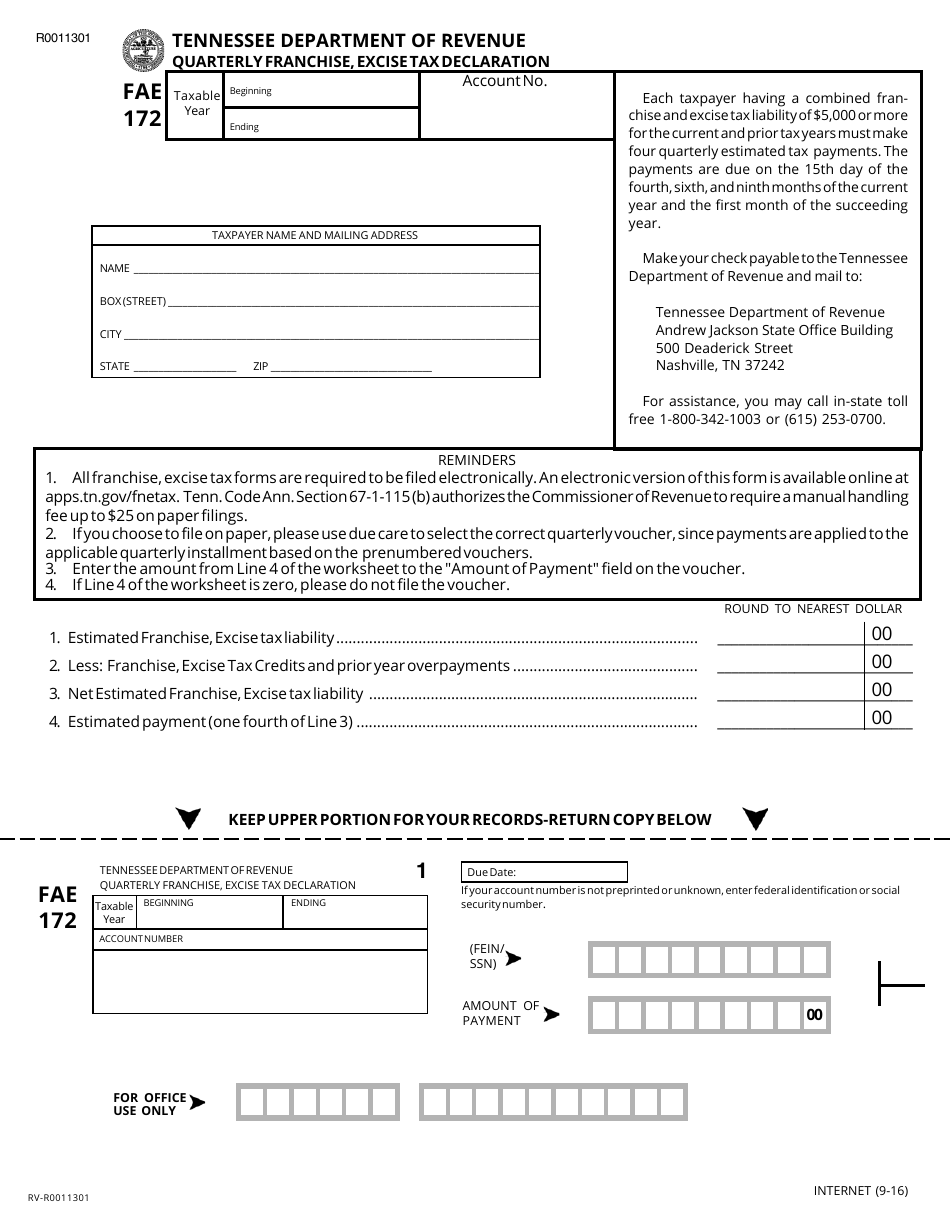

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

How is Tennessee excise tax calculated.

. We last updated the Franchise and Excise Tax Return Kit in February 2022 so this is the latest version of Form FAE-170. Taxpayer Services 500 Deaderick Street Nashville Tennessee 37242 Phone. TENNESSEE DEPARTMENT OF REVENUE Franchise and Excise Tax Job Tax Credit Business Plan RV-F1308601 918 Taxpayer Name Account Number Mailing Address Number of New Jobs FEIN Capital Investment and Job Creation Investment Period.

CST or visit wwwtngovrevenue for more detailed information. Download or print the 2021 Tennessee Form FAE-170 Franchise and Excise Tax Return Kit for FREE from the Tennessee Department of Revenue. Tennessee Department of Revenue 500 Deaderick Street Nashville TN 37242.

For questions or assistance with this form please call 615 253-0700 Monday through Friday 830 am-430 pm. ET-2 - Federal Bonus Depreciation is not Deducted for Excise Tax. Tennessee Department of Revenue Attention.

All entities doing business in Tennessee and having a substantial nexus in Tennessee except for not-for-profits and other exempt entities are subject to the franchise tax. 4 rows Business Mailing Addresses. 615 253-0700 1-800-342-1003 ln State Toll-Free E-mail.

Franchise Excise Tax Return Mailing Address Tennessee. The franchise tax is a privilege tax imposed on entities for the privilege of doing business in Tennessee. Please view the topics below for more information.

Box 1214 Charlotte NC 28201-1214. Corporate Income or Excise Tax Tennessee levies an excise tax of 65 on net earnings of corporations foreign and domestic arising from business done within the state or on state apportionment of total earnings of interstate corporations. The minimum tax is 100.

State Tax Forms. ET-5 - Deductible Business Interest Expense Carried Forward from Tax Years 2018 and 2019. ET-3 - Federal Section 179 Depreciation is Deducted for Excise Tax.

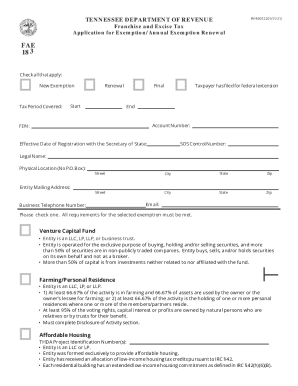

ET-4 - Interest Expense Limitation of IRC. Please mail completed applications and annual renewals to. If you have questions about Franchise And Excise Tax Online contact.

Franchise Excise Tax Registration. What is TN excise tax.

Form Fae170 Rv R0011001 Download Printable Pdf Or Fill Online Franchise And Excise Tax Return Tennessee Templateroller

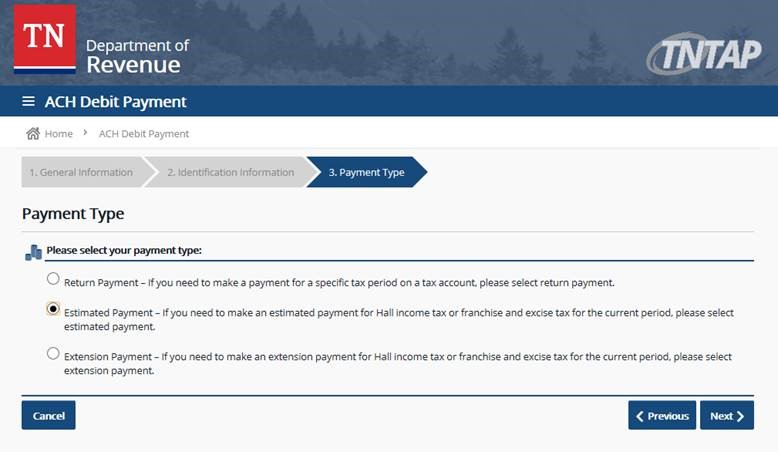

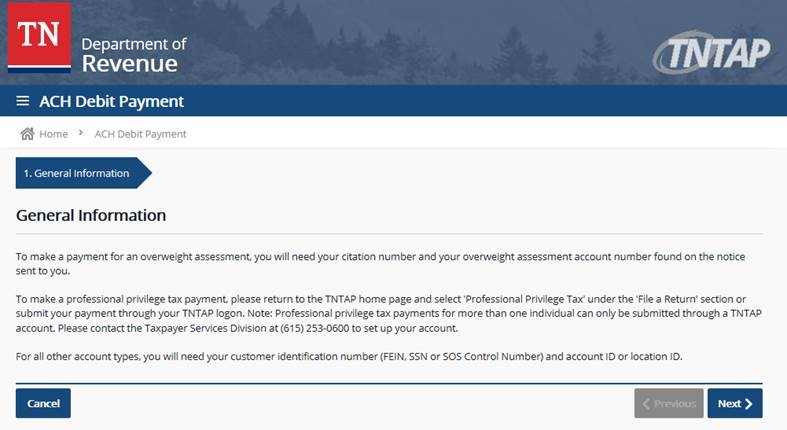

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Fill Free Fillable Forms State Of Tennessee

Tn Dor Fae 170 2019 2022 Fill Out Tax Template Online Us Legal Forms

Franchise Excise Tax Exemptions Farming Or Personal Residence Youtube

Get And Sign Tennessee Department Of Revenue Franchise And Excise Tax 2021 2022 Form

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Tennessee Franchise Excise Tax Price Cpas

Tn Fae 172 Form Fill Out And Sign Printable Pdf Template Signnow

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

Tennessee Franchise And Excise Tax Form Fill Out And Sign Printable Pdf Template Signnow

2017 2022 Form Tn Dor Fae 173 Fill Online Printable Fillable Blank Pdffiller